Banking-as-a-Service

Our BaaS (Banking as a Service) is delivered through strategic

partnerships with leading banks, enabling you to capitalize

on embedded finance. Transform your customers’ journey by

seamlessly integrating our loans, cards, and payment solutions.

This approach enhances engagement, unlocks new revenue streams,

reduces friction, and minimizes churn.

Seize the Opportunity

Forecasted to reach $38 billion by 2027, the Banking-as-a-Service market opens a world of opportunities. Natech’s platform is precisely engineered to help businesses harness this potential, offering streamlined solutions for scaling operations, managing risk, ensuring compliance, launching innovative products, and exploring new markets.

Embrace

$38 billion

estimated Banking-as-a-Service revenue for banks by 2027

Agility-as-a-Service: Your Platform For Growth

Streamline operations, create new revenue, and futureproof your business by

creating customized, compliant products that your customers will love.

Seamless Integration

Effortlessly adapt to market demands and rapidly expand your services with a versatile Banking-as-a-Service platform that can quickly and easily integrate with existing systems, allowing for fast adoption and a smooth transition. Solve compliance challenges, unlock growth opportunities and meet consumer demand for personalized experiences.

Comprehensive and Customizable

A full suite of Banking-as-a-Service solutions, covering everything from payments to lending. Our platform is highly customizable, meeting the unique needs of each client whether they are a financial or non-financial institution. Reduce operational costs and improve process efficiency, eliminating the need for complex in-house infrastructure.

Licensed for European Expansion

Expand your operations across Europe with a solution offering access to a full European banking license through a regulated bank and co-created with one of the continent’s largest financial institutions. Improve customer engagement and enhance trust, satisfaction, and loyalty in a competitive landscape.

Unlimited Possibilities

A modular platform that provides everything you need to deliver cutting-edge

embedded financial services.

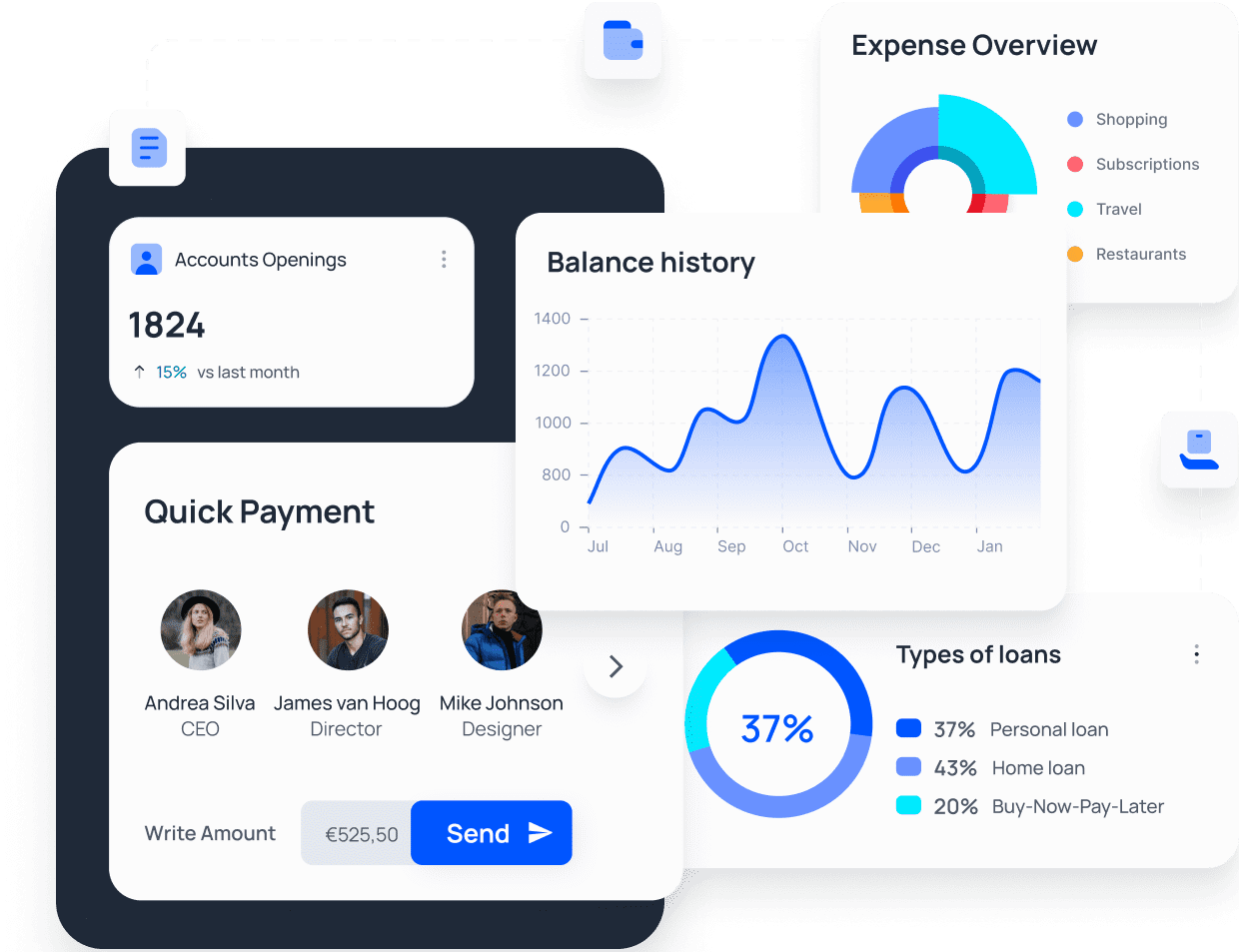

Payments

Transform your transaction process with easy-to-integrate payments solutions that optimize speed, security, and cost-effectiveness. Access a range of payment schemes, facilitate cross-border payments, or facilitate in-store and online transactions.

Cards

Empower your business with seamless spending experiences and easy integration with existing accounts. Issue branded debit or credit cards to build brand visibility and customer loyalty, or provide virtual cards for secure online transactions.

Lending & Buy Now, Pay Later

Expand your financial offerings with lending products that provide flexible financing options tailored to your customers’ needs. Enhance your retail experience and drive conversions with BNPL services that allow customers to split the cost of purchases.

Accounts

A solution enabling regulated and non-regulated financial institutions to give customers savings, deposit, safeguarding, and multi-currency accounts with real-time FX. Link prepaid cards to e-commerce accounts or provide accounts for gig workers.

Onboarding

Streamline customer onboarding processes, utilizing advanced technology such as facial recognition and liveness checking to ensure a secure and efficient process. Redefine user experience, and increase customer satisfaction to drive loyalty.

FX (Foreign Exchange)

Drive down costs and increase earnings with real-time FX management. Decrease spreads and offer customers competitive pricing or interbank rates, without changes in infrastructure. Access best-in-class FX rates and liquidity with an automated API solution.

Unlock Embedded Finance For Your Business

Discover a secure, end-to-end platform that creates unlimited possibilities for financial and non-financial institutions.

Modular Options

A comprehensive range of solutions that supports your ambitions and innovations at every stage of growth. Transform customer journeys with ease by embedding financial products into platforms and experiences.

Limitless Use Cases

Enable a huge variety of use cases and new revenue streams, ranging from payments for gig economy workers to decoupled cards or lending products including inventory financing and liquidity advancement.

Flexible Partner Integration

Natech’s innovative approach and wide range of APIs make integrations seamless and straightforward. Our platform encourages collaboration with ecosystem partners, enriching your capabilities.