Intelligent

Business Lending

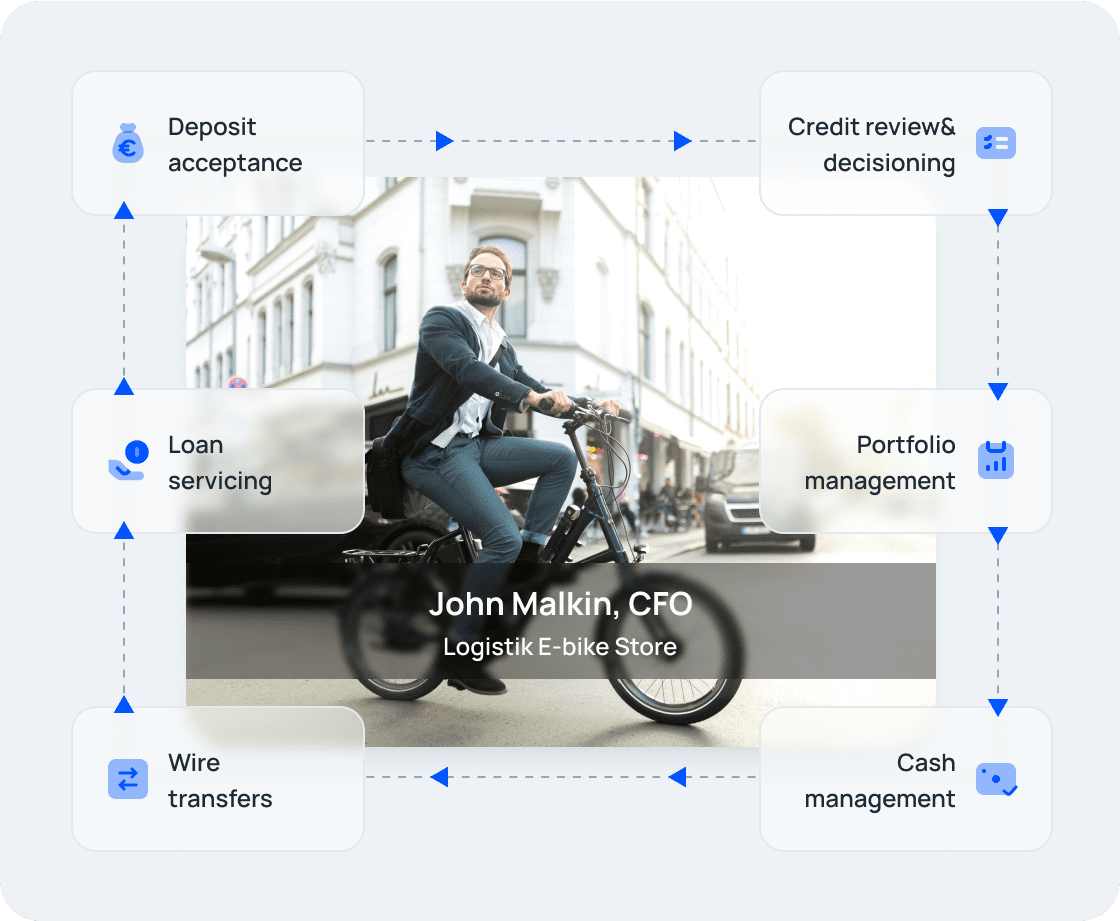

A complete and comprehensive platform that enables local and regional banks, as well as fintechs and neobanks, to

meet the evolving demands of businesses.

Key Benefits

Good For Business

Use cases

Game-Changing Use Cases

The banking market is evolving and consumers’ demands are changing – which means banks of all sizes have a unique chance to grow their market share. Natech’s comprehensive platform ensures customers have a great experience at every stage of their journey, helping you stay ahead of your competitors.

Features

Key Features & Solutions

The banking market is evolving and consumers’ demands are changing – which means banks of all sizes have a unique chance to grow their market share. Natech’s comprehensive platform ensures customers have a great experience at every stage of their journey, helping you stay ahead of your competitors.

Business-Centric Tools

Every business is different, so every business will have different financial needs. We offer a broad range of loan options tailored to meet the diverse financial needs of your businesses customers and help them strive.

- Open/revolving credit loans for working capital: Facilitate continuous operation with an open line of credit that supports businesses in need of immediate funds for operational expenses, cash flow management, or inventory procurement.

- Commercial mortgages for investment properties: Long-term solutions for businesses focused on real estate acquisition or expansion offering competitive, flexible terms and customizable repayment structures.

- Fixed and irregular instalment loans: Built for businesses with unique cash flow patterns, these loans allow variable repayments, aligning with clients’ cash flow to minimize the risk of default.

Efficiency and Compliance

Natech’s solution effortlessly handles the complexity that comes with managing business loans.

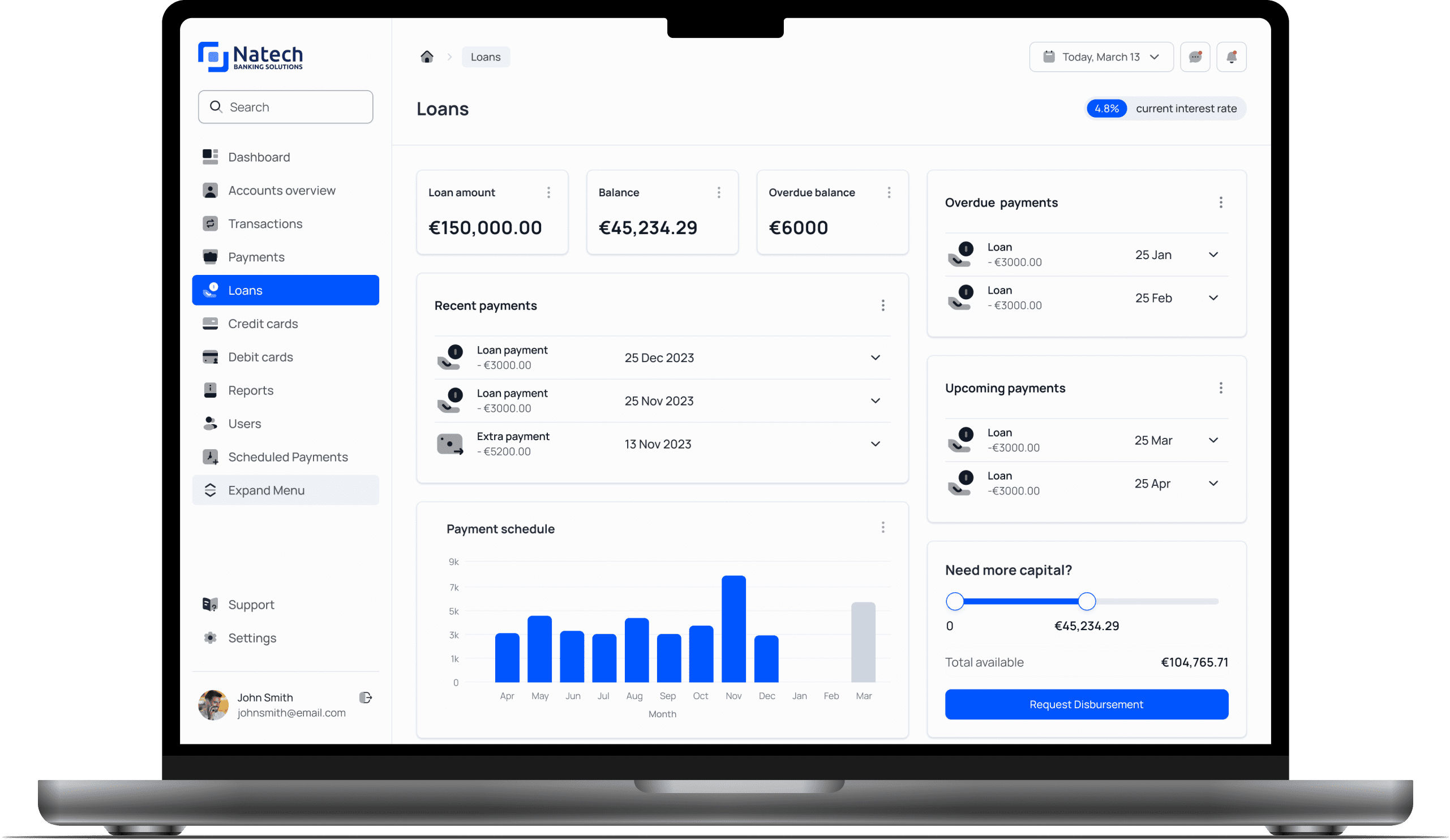

- Efficient Loan Management: We provide a system that can efficiently handle diverse and complex business loan portfolios, facilitating a smoother experience for lenders and borrowers alike.

- Rapid Application Processing: Capitalizing on Natech’s advanced technology and operational expertise, our platform accelerates loan application processing, leading to quicker loan disbursement and enhanced borrower satisfaction.

- Assured Regulatory Compliance: Natech’s platform provides built-in compliance functionality, with timely reporting and auto-updating features that ensure seamless adaptation to evolving regulatory requirements.

Custom Integrations

Blend our robust lending platform with your bank’s unique business approach.

- Seamless integration: The Natech platform allows for the integration of various loan types into one unified system, increasing operational efficiency and providing a holistic overview of your lending portfolio.

- Facilitate the creation of custom-tailored loan packages for businesses. Our platform’s flexibility allows the creation of bespoke loan packages that cater to the unique requirements of each business, thus delivering a higher degree of personalization and meeting diverse borrowing needs.

50%

Faster launches of new products. Speed up development and hit the market in half the time

75%

Cut IT costs by 75%, achieving unprecedented savings in technology expenses

100%

Elimination of end-of-day consolidation. Automate most IT operations

300%

Increase in available data. Triple the MIS depth of information to unlock deep insights