The Essentials

for Effective

AML Effective AML Compliance

A straightforward rules-based AML solution, deployed in as little as 2 weeks,designed to help both financial institutions and non-financial businesses prevent money laundering, fraud, and terrorist organization financing.

AML challenges extend beyond regulatory requirements

As transaction volumes grow and regulations evolve, disconnected data, manual investigations, high false-positive rates, and limited real-time visibility increase workload, slow response times, and raise the cost of compliance.

Natech AML Benefits

An integrated, flexible and cost-effective AML solution

Built on deep AML expertise, Natech’s solution simplifies complex operations through unified workflows, better visibility, and fewer false positives across customers, transactions, and regulatory requirements.

Maintain full compliance with local and regional AML regulations to reduce legal risks and costs, and adapt more easily to new regulations.

Improve your ability to detect and prevent financial crimes, reduce false negatives, and accelerate responses.

Reinforce customer confidence, strengthen your reputation, and gain the regulator’s trust.

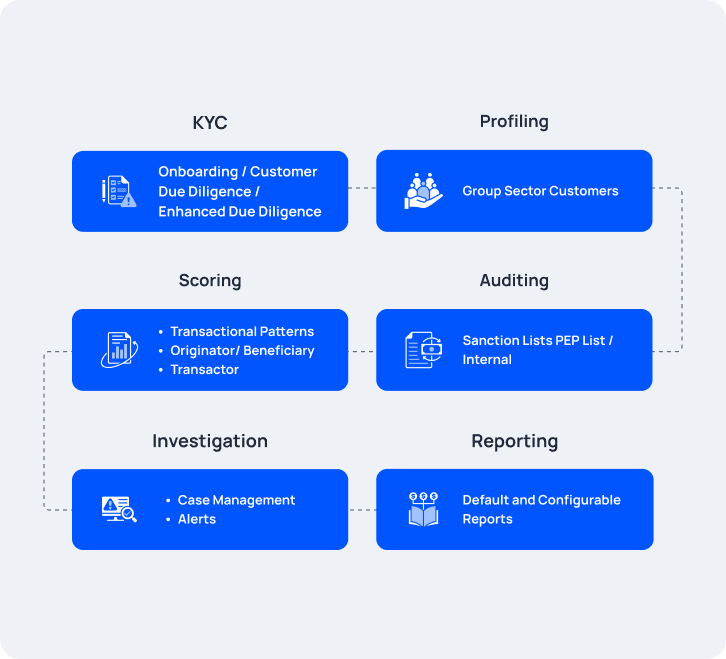

Key features

A robust and trusted AML solution

Natech offers a robust and cost-efficient solution for AML compliance and financial crime prevention, integrating seamlessly with any

core banking or CRM system while supporting global watchlists for comprehensive security.

Real-Time Monitoring

Instantly identifies and flags suspicious transactions, reducing the need for end-of-day batch processing.

Watch Lists Integration

Includes comprehensive checks against global and proprietary lists, such as INTERPOL Red Notices and the UN Consolidated List, ensuring thorough background screening.

Dynamic Scoring

Evaluates transactions and customers using both standard and customizable rules for accurate risk assessment.

Custom Rule Capability

Empowers institutions to define and implement their own rulesets, accommodating unique compliance needs.

Seamless Integration

Integrates smoothly with existing banking systems, including Natech’s Core Banking solution, enhancing operational efficiency with minimal IT support required.

Flexible Reporting Options

Offers multiple reporting formats to meet specific organizational and regulatory requirements.

Use cases

Who is it for?

Natech AML is designed to meet the needs of financial institutions of all sizes, from traditional and digital-first banks to microfinance institutions, and of non-financial businesses which deal with financial transactions or embed them in their value proposition. It ensures compliance, reduces risks, and enhances operational efficiency across all sectors.

Financial Institutions Seeking AML Capabilities

Adopt a flexible, user-friendly AML solution that ensures compliance, strengthens risk management, and protects against potential threats.

Neobanks and Digital-First Institutions

Benefit from a scalable and adaptable AML solution designed to integrate seamlessly into innovative banking ecosystems.

Microfinance Institutions

Enhance financial transparency and reduce risks with AML measures that fit the unique needs of microfinance operations

Servicers and Other Non-FSIs

Maintain compliance and mitigate risks effectively, even in specialized financial environments, by leveraging adaptable AML capabilities.

Banks

Ensure seamless compliance with evolving regulations while optimizing operational efficiency and maintaining customer trust.

Payment Providers and EMIs

Prevent financial crimes and maintain compliance through real-time transaction monitoring and dynamic risk assessment capabilities.

AML solution case study

See how choosing Natech AML enabled the Cooperative Bank of Chania to navigate complex compliance requirements and tackle rising financial crime with greater agility.