From Technology to Transformation: Assessing Core Banking Maturity for Maximum Value

Discover how Natech’s 4-step Solution Maturity Model helps financial institutions move beyond “go-live” to unlock real value from their core banking platforms. Whether scaling existing investments or breaking free from stalled legacy systems, learn how Natech empowers FIs to modernize with confidence and speed.

By Donncha McCarthy, Chief Customer Success Officer, Natech Banking Solutions

Modernizing a core banking platform is one of the most significant steps a financial institution can take. Much of the commentary available on the subject focuses on simplifying the journey through progressive renovation, building around your existing core and leveraging API connectivity to bolt on solutions to address specific functional areas. But buying the technology is only part of the journey. To truly deliver the anticipated or expected value, FIs need to assess their solution maturity—not just in terms of technology adoption, but in how effectively they can extract sustained benefits from their platform over time.

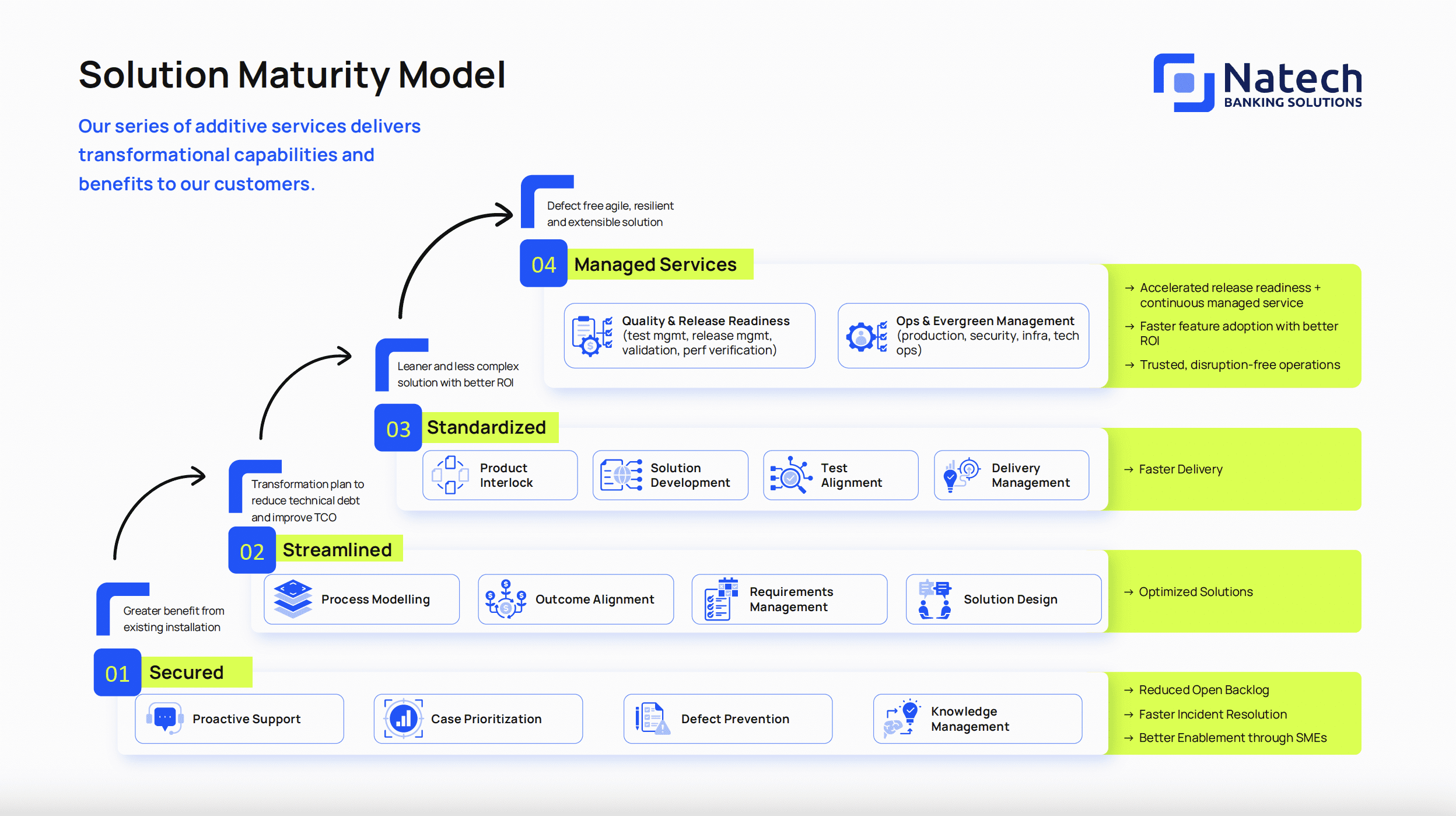

At Natech, we’ve seen that maturity is less about how “new” a system is and more about how well it is embedded into operations, people, and strategy. To support our clients on this journey, we developed a 4-step Solution Maturity Model, which illustrates the services and benefits institutions should expect at each stage. Our clients are small to mid-sized FIs who compete with much larger organizations for market share, so taking the right decision is often driven by how efficiently they can come to market with their innovations to maintain their relevance. Getting the foundations right is an essential step towards ongoing success.

Why Maturity Matters

When an institution replaces or upgrades its core banking system, particularly when migrating from another vendor, the risk is that the investment stops at “go-live.” Without a roadmap for progressive improvement, institutions often fail to capture the full operational efficiency, customer experience gains, and agility that modern core technology provides.

Our maturity model sets out clear levels, each with defined services, goals, and outcomes. Clients can decide where they want to be on the scale, and we work with them to design a practical roadmap to get there. This provides a transparent way of assessing current capabilities and ensuring that the foundational steps are in place to bring an FI higher on the maturity model.

The Four Levels of Core Banking Maturity

- Secured – The foundation. Focused on gaining greater benefit from the existing installation. Get the basics right and ensure that the organization can support the solution effectively.

- Services: proactive support, case prioritization, defect prevention, knowledge management.

- Outcomes: reduced open backlog, faster incident resolution, better enablement through SMEs.

- Streamlined – A transformation plan to reduce technical debt and improve total cost of ownership (TCO). Having established the foundation, it’s time to review options and define the outcomes that the business expects from the solution.

- Services: process modelling, outcome alignment, requirements management, solution design.

- Outcomes: leaner operations, reduced complexity, optimized solutions with better ROI.

- Standardized – Establishing consistency and predictability in operations and delivery. The absolute minimum level any organization should achieve when implementing a new solution but also a point on the maturity model where incumbent solutions should achieve.

- Services: product interlock, solution development, test alignment, delivery management.

- Outcomes: faster delivery, resilient operations, and a solution architecture that supports growth.

- Managed Services – The highest level of maturity, ensuring resilience and continuous improvement. Once you have standardized, it’s now about optimizing, increasing automation, and leveraging tooling to minimize business disruption.

- Services: quality & release readiness, performance validation, evergreen operations, infrastructure and security management.

- Outcomes: accelerated release readiness, continuous managed service, faster feature adoption, trusted and disruption-free operations.

Supporting Growth at Every Stage

For many of our long-term partners, this model is not about starting from scratch—it’s about scaling further. By progressing through the stages, existing clients can:

- Expand capabilities without disruption.

- Continue reducing technical debt while unlocking new efficiencies.

- Adopt new features and innovations faster with lower risk.

This model helps ensure that your Natech investment grows with you, supporting both your day-to-day operations and long-term strategy.

We also recognize that many financial institutions are effectively stuck at Step 1 (Secured) with their current core providers—operationally functional, but unable to streamline, standardize, or move into value-added services.

This is where Natech differentiates itself. We are:

- A trusted partner – our relationships are built on honesty, transparency, and a shared commitment to enabling your institution’s success.

- Personal in our approach – every client matters to us, regardless of size.

- Responsive – our teams answer questions quickly, without layers of bureaucracy.

- Hands-on partners – guiding you step by step through the maturity process.

- Service-focused – quick, attentive customer care is part of our DNA.

At Natech, our goal isn’t just to deliver technology but to empower financial institutions to modernize at their own pace, with the confidence that they have a partner who will guide, enable, and stand beside them every step of the way. We help you progress through maturity with confidence, ensuring you capture the full value of your transformation.

Making the Journey with Natech

Our approach is additive; each step builds on the one before. This ensures transformation is not a one-off IT project, but a managed, de-risked evolution that continually adds value.

- Clear Outcomes – every step has measurable benefits.

- Critical Service Components – migration support, process redesign, testing, and ongoing support.

- Collaborative Roadmapping – clients choose their desired maturity level, and we guide them there.

The Payoff

Institutions advancing through the maturity model see tangible benefits:

- Lower operational costs and improved ROI.

- Faster product launches and feature adoption.

- Greater resilience to market changes and regulatory demands.

- Enhanced customer satisfaction through seamless, personalized services.

In today’s financial services market, maturity is the bridge between technology investment and long-term competitive advantage. Wherever you are today, the journey is worth making, and we’re here to ensure you get there with speed, certainty, and measurable value.

Ready to assess your bank’s core banking maturity?

Let’s work together to define your target level, build a transformation roadmap, and ensure you get the full value from your platform. Contact us today to start your journey.

Donncha McCarthy is Chief Customer Success Officer at Natech Banking Solutions, leading customer transformation strategies across Europe. With over two decades in banking technology, he helps financial institutions modernize, scale, and compete in a digital-first era.