Behind the Screens: What Powers a Digital-Only Bank

Discover how Natech’s modular technology stack powers Snappi, a fully digital ECB-licensed bank, with composability, real-time compliance, and rapid time-to-market baked in from day one.

Table of contents

By George Nikolaropoulos, Chief Technology Officer, Natech Banking Solutions

Dissecting the modular stack behind Europe’s newest neobank, Snappi

When people think about launching a neobank, they often picture an ambitious idea with a long and complex build, often involving a great deal of integration work around a bare bones neocore.

Snappi, a digital-only, ECB-licensed bank launched in 2025, powered by Natech’s all-in-one neobanking platform, proved that ambition doesn’t necessarily mean complexity. Snappi runs entirely on Natech’s modular front-to-back banking stack, which was built for speed-to-market, scale, and continuous evolution. From day one, the goal was to prove that a fully regulated, pan-European neobank could go live fast with the kind of flexibility and resilience modern financial institutions need, without spending years in development.

Let’s take a look at what actually powers Snappi behind the screens.

The Natech Banking Platform

A front-to-back platform deployed in under 90 days

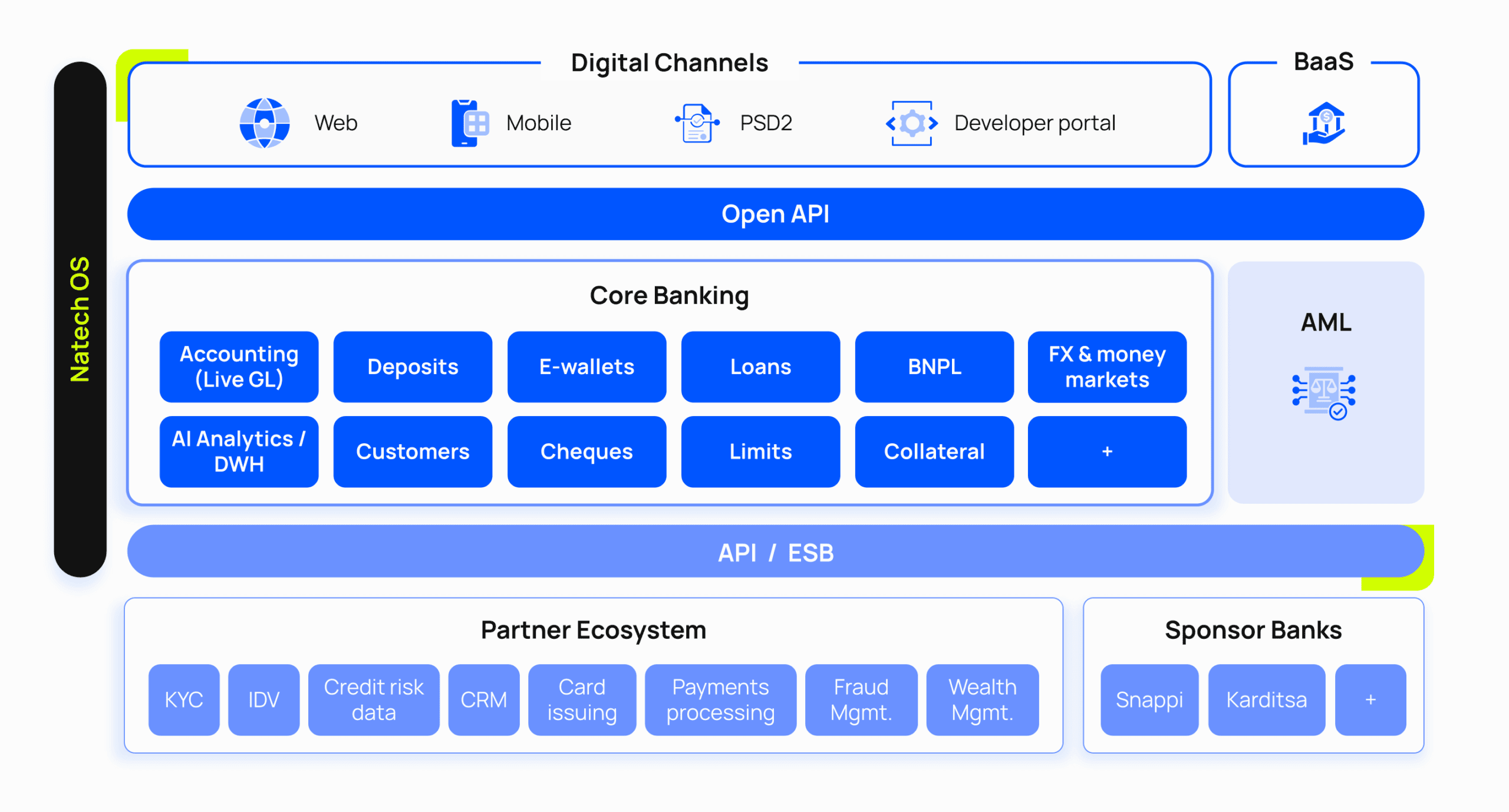

At the heart of Snappi is Natech’s composable, cloud-first, BaaS-ready banking system. The platform is modular by design, which means every major building block, like core banking, digital channels, and end-to-end compliance, can be configured, launched, and scaled independently.

What’s included:

- Nextgen mobile and web apps developed in partnership with Snappi

- A rich, modular core banking system that enables novel end-to-end solutions

- End-to-end compliance from day one, including robust rules-driven AML

- BaaS infrastructure for fully compliant BaaS provisioning, a twin engine for growth

- An API framework to seamlessly connect with any third-party provider or channel

- Cutting-edge technology and multi-layered enterprise architecture to ensure maximal efficiency, scalability, evolvability and resilience

With this setup, Snappi was able to onboard its first 20,000 users within weeks of launch, with no disruption and full audit trails in place.

Natech’s 8 Technology Frameworks

Technology frameworks for maximum agility and efficiency

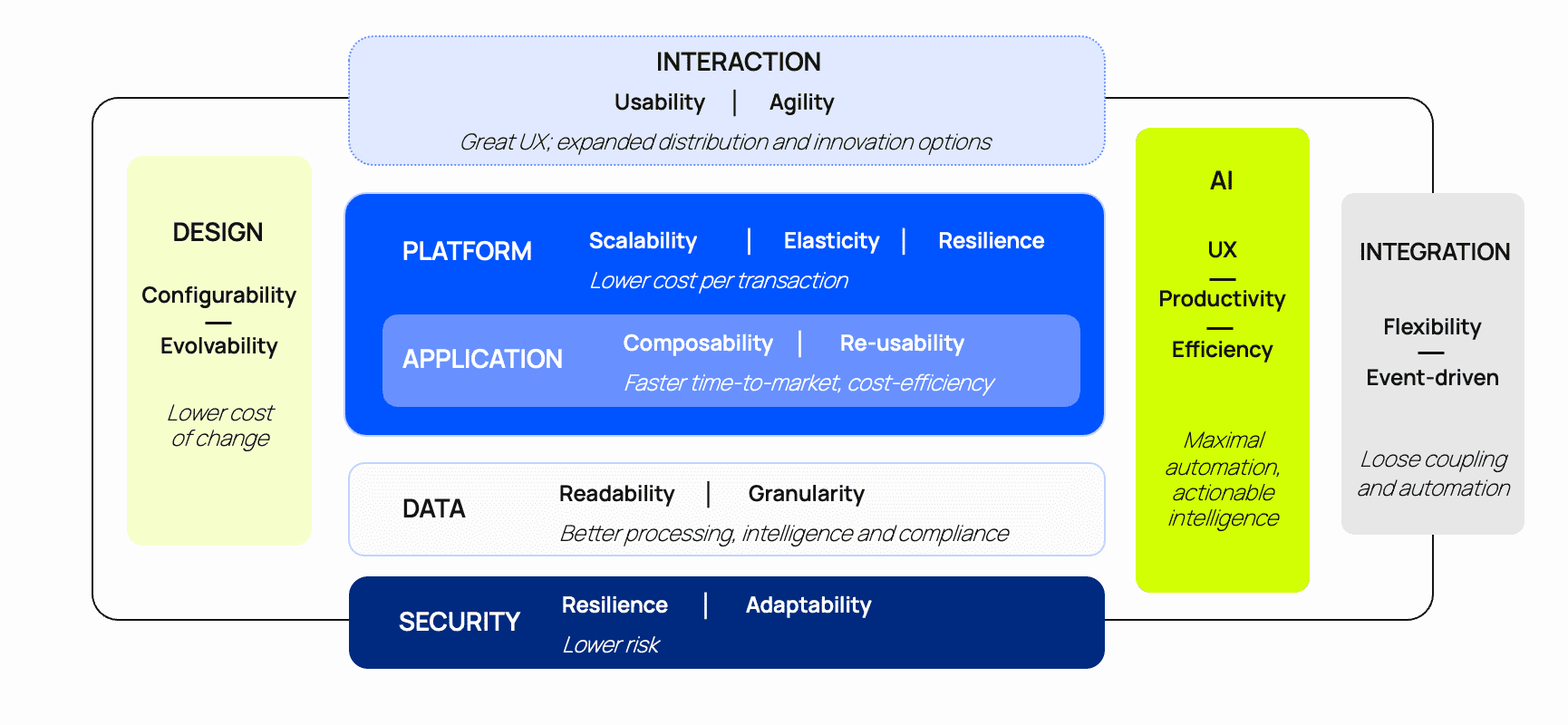

To ensure competitive agility and minimize the cost of running and evolving the bank, the platform’s seamlessly integrated yet independently evolving layers are structured around eight enterprise-grade frameworks, covering Design, Interaction, Platform, Application, Data, Integration, Security, and AI.

Design Framework – Provides modular, model-driven development tools that accelerate change cycles and simplify rollout of new products and services.

Interaction Framework – Enables seamless omnichannel UX through decoupled front-end layers and partner-ready APIs, supporting mobile, web, and future interfaces without redesigning the back-end.

Platform Framework – Delivers a cloud-native, containerized environment that scales effortlessly while reducing infrastructure complexity and operational costs.

Application Framework – Built on microservices and CI/CD pipelines, it allows continuous deployment of new features and rapid evolution of business logic without touching the core.

Data Framework – Centralizes access to real-time, high-performance data across services, enabling consistent MIS reporting, dynamic personalization, and regulatory compliance.

Integration Framework – Uses event-driven architecture and standard message formats to orchestrate systems in real time, reducing friction and slashing integration timelines.

Security Framework – Embeds IAM, RBAC/ABAC, DevSecOps, and audit trail controls into every layer, ensuring proactive compliance and security from day one.

AI Framework – Powers intelligent automation, from transaction scoring to dynamic workflows, with built-in support for machine learning models and LLMs that enhance UX and risk management.

These frameworks allowed Snappi to scale quickly, add new services like “Snappi Pay Later,” and deliver neobank-grade UX all while staying lean and compliant.

Composability and pre-integration make the difference

One of the biggest misconceptions about banking platforms is that speed comes at the cost of stability or compliance. That’s not true when composability is built into the architecture from day one.

Snappi’s stack was designed to scale and evolve, not just to launch quickly. Every module is API-first, which means:

- External partners can plug into the platform easily

- Internal teams can experiment without touching the core

- New services like BNPL or embedded credit can be added without rebuilding the architecture

Thanks to Natech’s certified ecosystem of pre-integrated partner services, Snappi didn’t need to source and connect a patchwork of vendors. This also means faster compliance onboarding, clearer audit trails, and lower operational risk.

Why this matters for other banks

What we’ve built for Snappi is now available to any bank or fintech that wants to launch a digital-only proposition, a dual-brand strategy, or embedded financial services. Whether you’re a Tier 1 bank or a smaller community bank looking to serve digital-first customers, or a non-bank platform aiming to offer e-wallets or cards, the same building blocks apply.

The technology isn’t theoretical. It’s live, licensed, and scaling today.

Digital banking doesn’t need to be over-engineered. With the right architecture, you can go live faster, stay compliant from day one, and build exactly what your customers need without locking yourself into a legacy system.

Snappi is proof of that. And we’re just getting started.

The same architecture is now available for banks that want to differentiate. See how it could accelerate your next launch. Book a demo today!