Natech for Neobanking

Launch your fully-fledged neobank in just months with our all-in-one, licensing-ready solution.

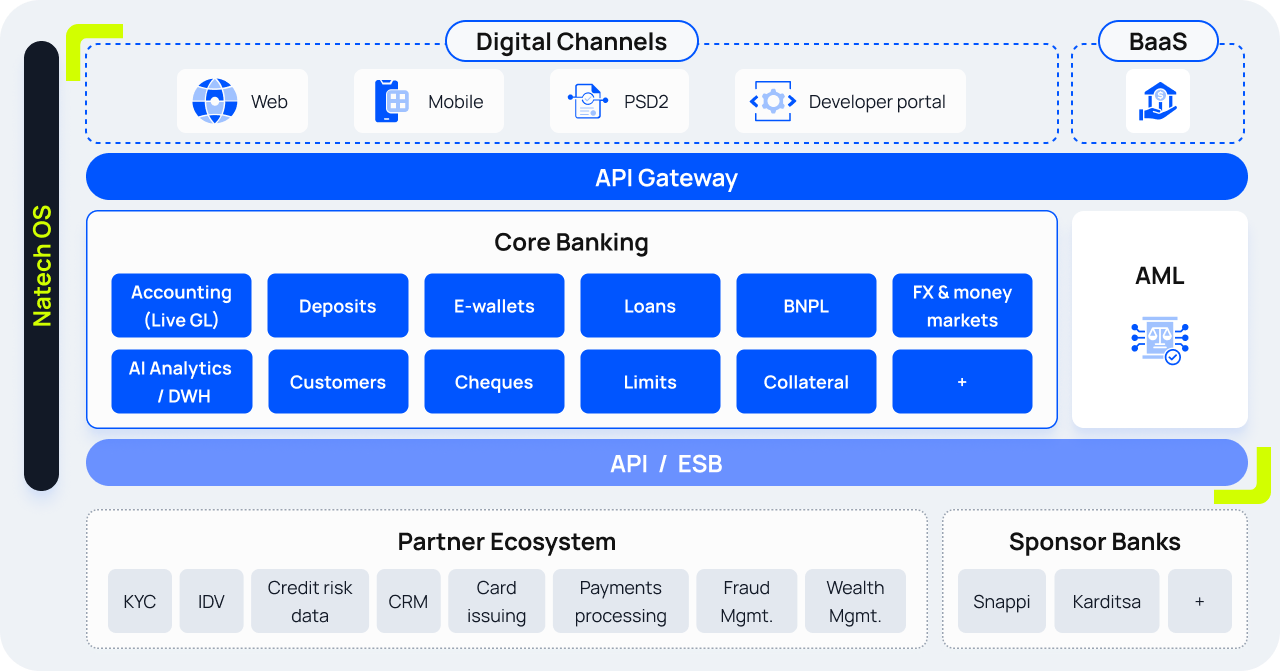

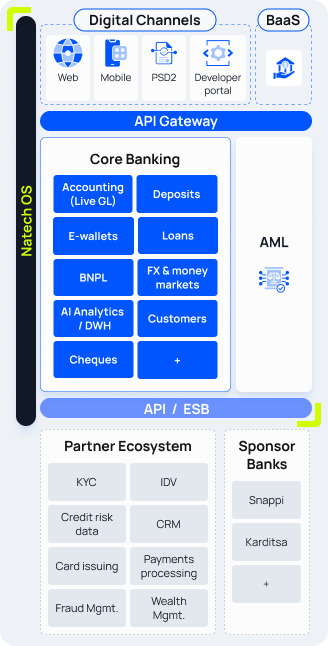

Natech empowers traditional banks and new entrants to launch a full, front-to-back neobank in just months. Next-generation digital channels, designed and proven through Snappi, our own successful neobank, integrate seamlessly with our core banking engine, AML solution, and BaaS infrastructure.

Developed with our own ECB-licensed neobank

Twin engines for growth: digital banking + BaaS

Go live in < 90 days

Nextgen products: e-wallets, BNPL

Cloud-first, API-driven

BaaS-ready

Powering Snappi, the first-ever ECB-approved neobank in Greece

Built on firsthand experience launching and operating Snappi, Natech’s front-to-back platform supports full neobank operations, regulatory readiness, proven scalability, and expansion into growth models such as BaaS.

“With Natech, we’ve created a brand that’s digital-first yet grounded in trust, combining the agility of fintech with the safety and compliance of a fully-licensed EU bank.”

All your neobanking needs, from core to nextgen

customer UX, on one platform

The Natech Digital Bank Stack

Outstanding front-to-back efficiency for truly competitive neobanking

Ready to build your neobank faster, safer, smarter?

Let’s explore how you can accelerate your neobank’s licensing, launch and growth without trading off

between fintech agility and bank trustworthiness.