Forward-Thinking

Retail Banking Solutions

for the Modern Customer

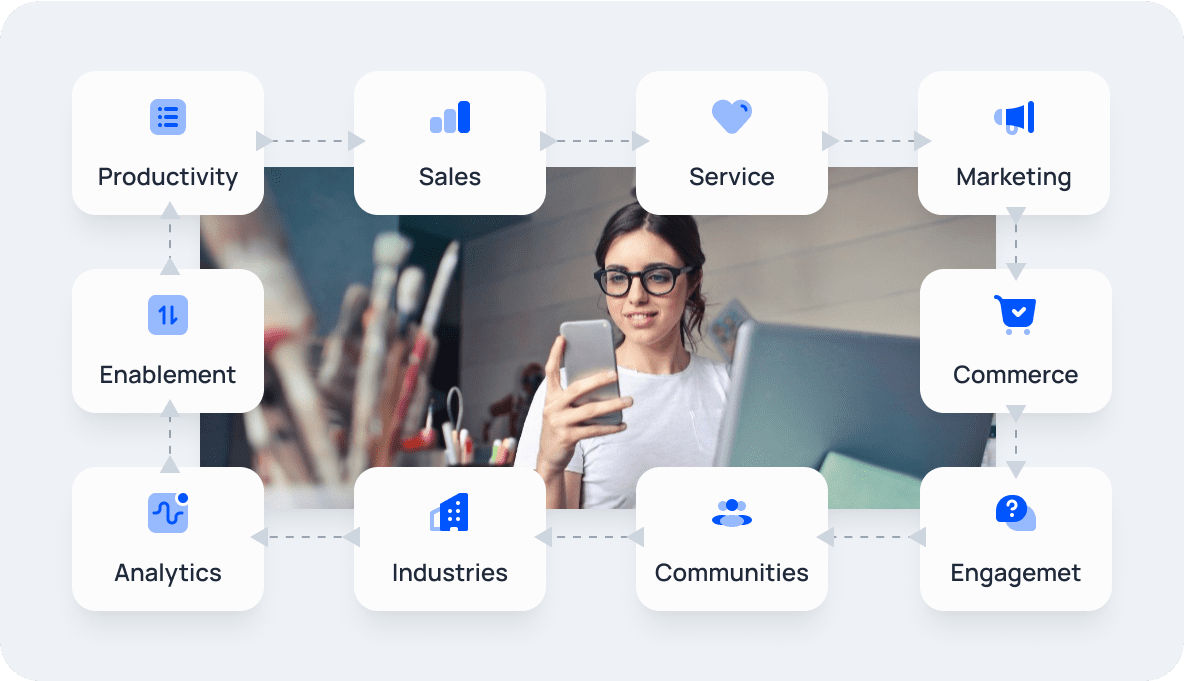

Become the bank of tomorrow — today — with a modular product suite that’s tailor-

made to empower local and regional financial institutions. Natech’s Retail Banking

solution is an all-in-one growth platform that scales with your ambitions, offering

everything you need to delight customers and stand out from the crowd.

Features

Extraordinary Experiences From End-to-End

The banking market is evolving and consumers’ demands are changing – which means banks of all sizes have a unique chance to grow their market share. Natech’s comprehensive platform ensures customers have a great experience at every stage of their journey, helping you stay ahead of your competitors.

Configuration

Product Customization: Configure and customize financial products using Natech’s core banking system. Natech enables banks to craft a platform that’s bespoke, fully featured, and perfectly poised to capture emerging opportunities or respond to clients’ changing demands. Begin your digital transformation with a solution that’s as unique as you need it to be.

Onboarding

Digital Account Opening: Simplify account opening with Natech’s fast, seamless, and paperless digital processes. Make a great first impression and reduce friction for both prospects and employees at every stage.

Product and Service Activation: After being onboarded, new customers can quickly activate banking products and services such as deposits, loans, and transactions across Natech’s digital engagement channels, including web, mobile, and back-office.

Compliance

Fraud Prevention: Natech’s risk management and compliance modules protect against fraud, ensure AML compliance, and maintain a secure banking environment.

Credit Registry and Reporting: Capabilities for credit registry and reporting enable you to manage credit risks and comply with regulatory requirements.

Servicing

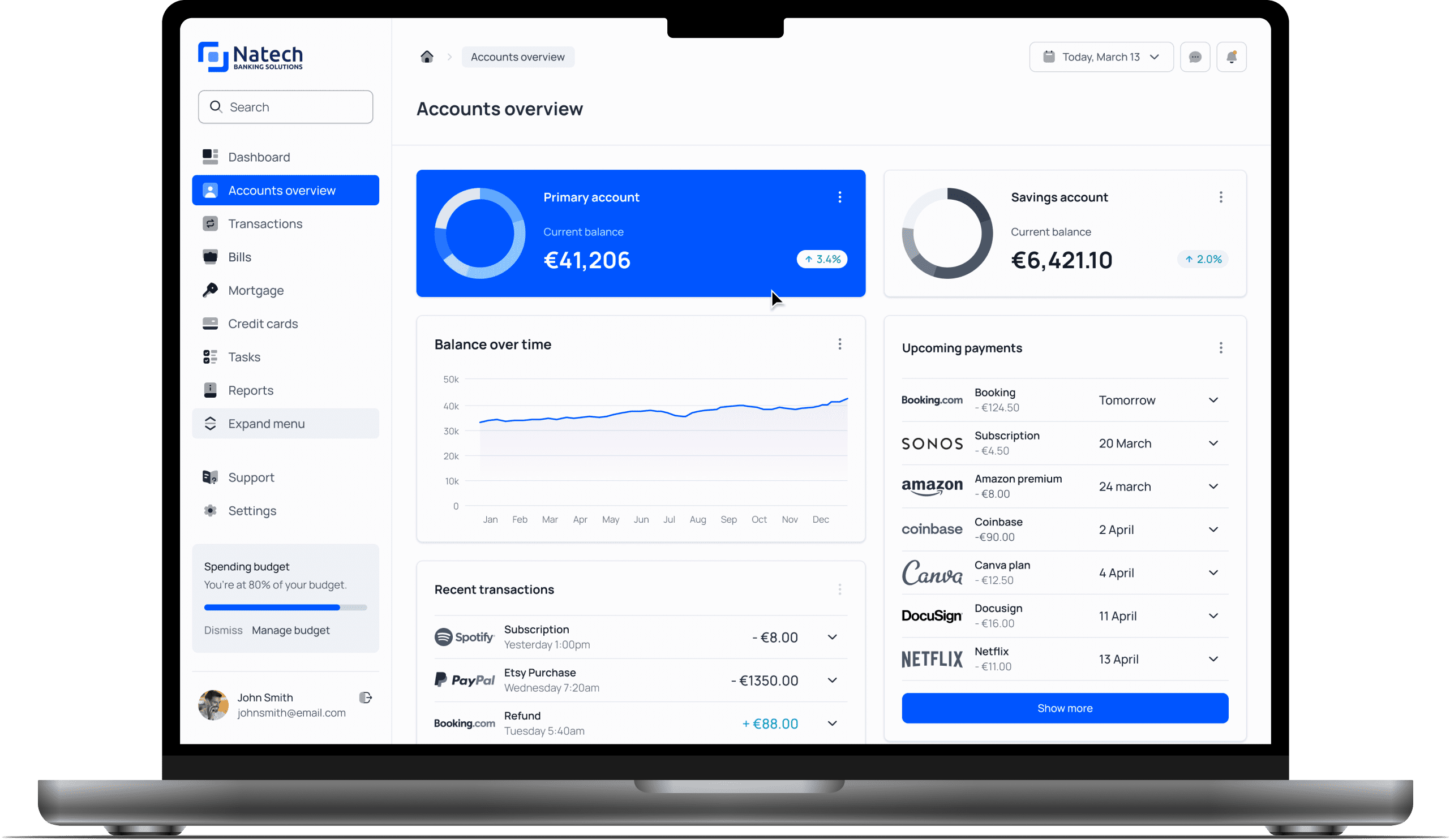

Daily Banking Transactions: Enable customers to perform daily banking transactions with ease, leveraging Natech’s core banking and digital channels for a seamless experience.

Loan Origination and Management: Natech’s lending solutions enable efficient loan origination, management, and servicing, including everything from mortgages to personal loans.

Personal Finance Management (PFM): Third-party integrations let you offer personal financial management (PFM) tools and features that let customers manage their finances, budget, and plan for future financial needs.

Retention

Cross-Selling and Upselling: Identify opportunities to offer additional products and services to existing customers, enhancing their banking experience and increasing their lifetime value.

Build Relationships: Engage customers with personalized experiences to foster long-term relationships and drive loyalty.

Innovation

Product Development: Our flexible platform enables you to quickly develop and launch new products or services to capture opportunities and meet customer demands. Natech’s solution is also integrated with a global ecosystem of fintech partners, providing support and inspiration as you grow.

Growth

Market expansion: Forward-thinking banks don’t stand still – and Natech is there to support you every step of the way. Our scalable solutions enable banks to easily expand into new markets and target customer segments to drive growth and increase market share.

Benefits

Retail Banking Solution Simplified

Features