The Solution to Profitable

Retail Lending

A simple and customizable retail lending solution that empowers local and regional banks, as well as fintechs and neobanks, to delight customers, build loyalty, and serve the diverse needs of their communities.

Benefits

Speed Up Your Journey From Lending To Value

Use cases

Unlock Your Ambitions

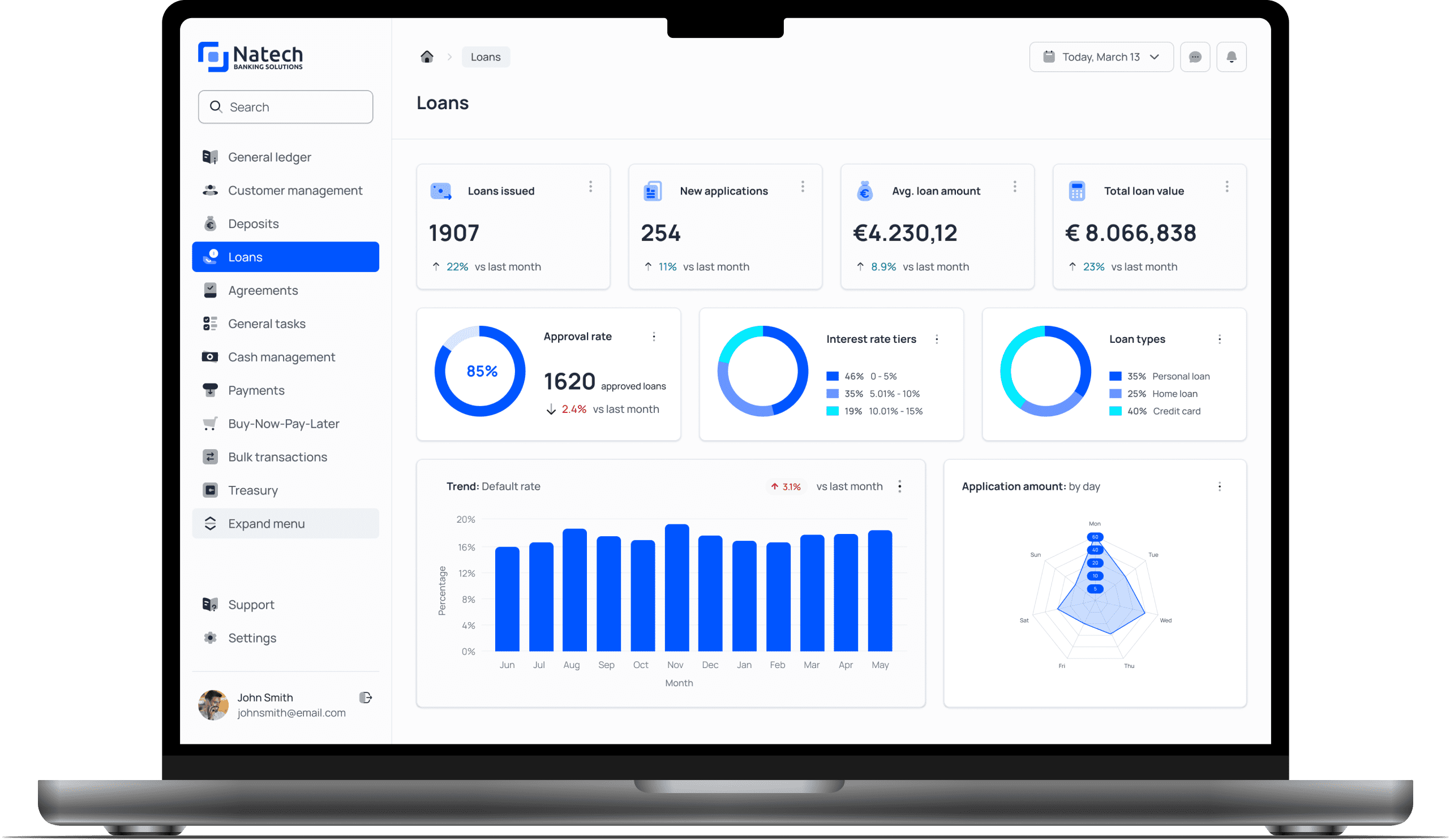

Natech’s all-in-one solution offers everything you need to deliver extraordinary lending experiences

Key features

Driving Retail Lending Forward

Discover the power of our retail lending solutions: comprehensive operations, flexible customization, enhanced digital customer

experiences, and robust security and compliance. Built on a scalable architecture to grow with your needs.

Comprehensive Retail Lending

& Banking Operations

A solution that seamlessly integrates with existing banking systems and supports all back-office operations for lending, including loan management, accounting, and collateral management. Our live General Ledger ensures 24/7 banking operations without end-of-day processing.

Flexible & Adaptable

Product Engine

Define and customize loan products, setting characteristics such as fees, loan terms, repayment schedules, and interest rates. Offer a range of lending products including mortgages, working capital loans, fixed or irregular installment loans, and subsidized/co-funded loans.

Digital Channels for

Elevated Digital CX

A simple way to deliver digital banking through web and mobile channels, enabling customers to view loans, perform transactions, and manage their accounts online. Digital origination minimizes the need for physical branch visits and enhances the customer experience.

Modular & Scalable

Architecture

Add optional modules when you need them, such as cheques, standing orders, treasury, and more, catering to specific banking needs. Our adaptable infrastructure supports development on-premises, on the cloud, or as Software as a Service (SaaS).

Regulatory Compliance &

Security

Our integrated Anti-Money Laundering module ensures compliance and enables the monitoring of suspicious transactions. Built around robust security protocols, it conforms to global security standards, ensuring data encryption and secure operations.

Customization &

Configuration

Our flexible platform lets you easily merge and structure loans, offering integrated credit decision models to reduce risk and an efficient back-end to reduce administrative burdens. Build a bespoke platform that expands as you grow and scales with your ambition.

Customer Spotlight

Their journey. Our shared success.

50%

Faster launches of new products. Speed up development and hit the market in half the time

75%

Cut IT costs by 75%, achieving unprecedented savings in technology expenses

100%

Elimination of end-of-day consolidation. Automate most IT operations

300%

Increase in available data. Triple the MIS depth of information to unlock deep insights