Natech

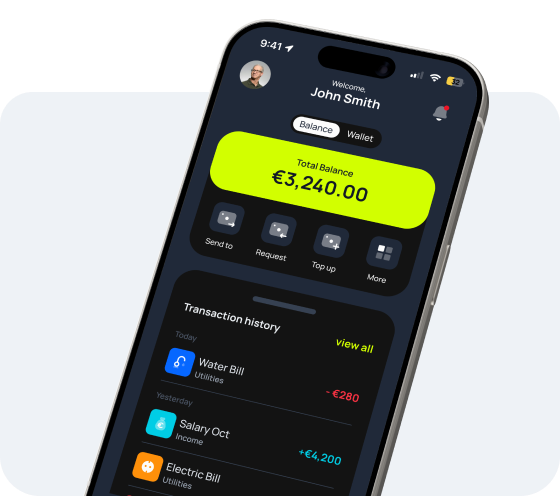

Core Banking

A modern core that unlimits growth and slashes costs for small-and mid-sized banks

Operate and grow leaner, faster, and smarter with a modern core banking system that eliminates legacy complexity, batch processing, and barriers to growth.

The core that makes your bank a best-performing bank!

Overcome the cost, complexity, and rigidity of your legacy infrastructure

Built for modern banking operations

Natech Core Banking delivers real-time processing on a proven, flexible core that supports both traditional banking operations and new digital business models, without forcing banks into a single deployment approach or disrupting regulatory control.

Proven over 20+ years

Full retail and business banking functionality

Real-time processing, no EOD batches

Modular, hybrid-ready architecture

API-ready, BaaS-ready

Deployed in less than 90 days

Powering limitless growth and innovation

BaaS-ready from day one

Built for speed and simplicity, Natech’s enterprise-grade architecture unifies modern technologies to cut the cost and risk of operating, scaling, and innovating, whether modernizing the core, launching new services, or embedding finance.

Banks

- Build and grow your BaaS offering on your core platform

- Expose banking products as-a-service via open APIs

- Deliver end-to-end BaaS to fintechs and embedders

- Ensure full compliance and security across every partnership

Embedders

- Access ready-to-use banking products

- Embed finance fast and reduce regulatory risk

- Connect via open APIs and pre-built integrations

Capitalize on the €100-billion embedded finance opportunity!

Launch and grow your BaaS business on your Natech Core Banking platform

to unlock new margin-rich revenue streams.

We’ve done all of this before. Successfully. Many times.

Cooperative Bank of Karditsa Case Study

Ready to modernize your core without compromise?

Let’s talk about replacing constraints with flexibility, cutting costs,

and unlocking growth with a modern core.