Natech for Microfinance

Launch or modernize your MFI in just months to accelerate impact while slashing costs

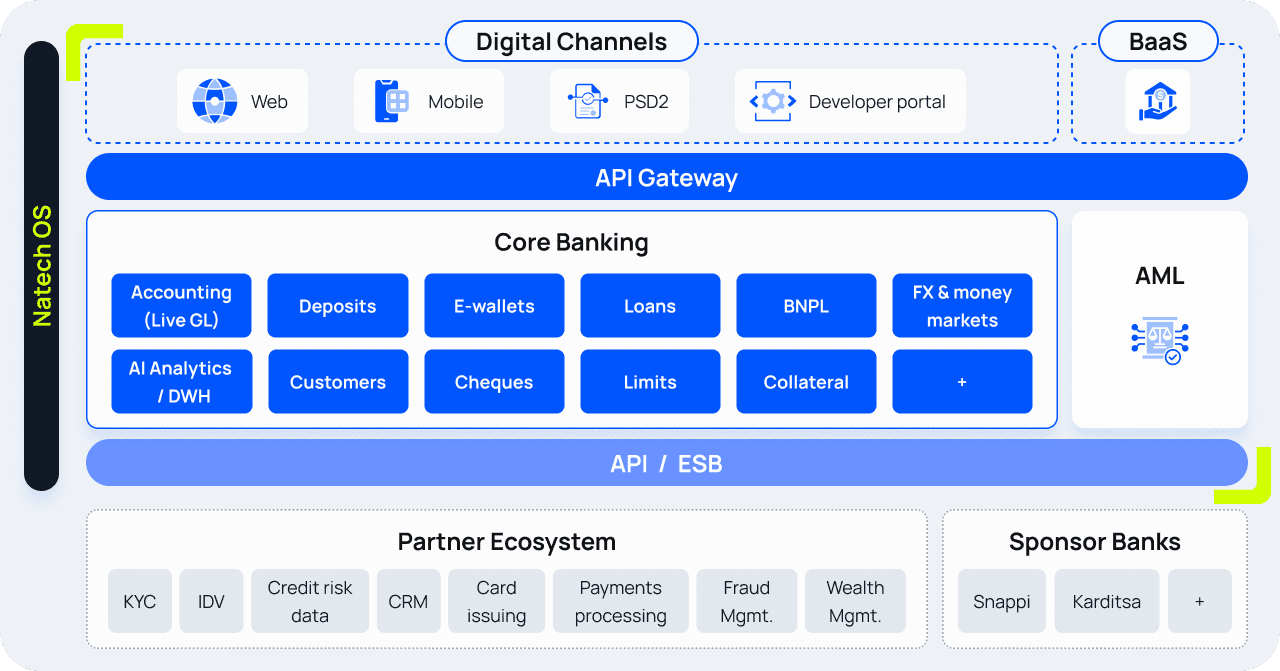

Natech empowers microfinance institutions (MFIs) of all sizes to automate and streamline operations, scale multichannel lending, and ensure full compliance – all on a fully unified yet modular microfinance platform with a modern core, nextgen digital apps, and bank-grade AML.

20+ years serving the microfinance industry

A single, modern, cloud-based platform

End-to-end loan and client management

Digital onboarding, pre-KYC screening

Real-time credit scoring and AML

Rapid application processing for fast disbursement

Becoming a digital-first MFI:

Microsmart’s success story

1st

licensed MFI in Greece

100%

digital microfinance experience

A fraction

of the time to disburse loans

100%

regulatory compliance from day one

40%

lower cost-to-serve

80%

Of customers excluded from banking

“Our collaboration with Natech marks the beginning of our journey to offer financial access and support services to businesses and citizens traditionally not served by conventional banks.”

All your neobanking needs, from core to nextgen

customer UX, on one platform

Digital apps and UX for instant onboarding, mobile and web access,

24/7 self-service

Real-time core with full microfinance accounting and zero EOD batch delays

Built-in AML with real-time monitoring and automated risk alerts

e-KYC integration with national ID systems for fast, remote verification

Full support of physical branches, on-site loan officers

Outstanding front-to-back efficiency for truly competitive neobanking

75%

Lower IT costs vs. traditional cores

50% faster

rollout of new loan programs

100%

real-time processing

< 90 days

to go-live

100%

compliance coverage from day one

40%

lower cost-to-serve

Ready to modernize your operations and accelerate impact?

Let’s explore how you can slash costs while accelerating your lending and outreach, without sacrificing

compliance or your social mission.