Natech Powers Scalable Growth in Neobanking: Snappi Reaches 10K Accounts

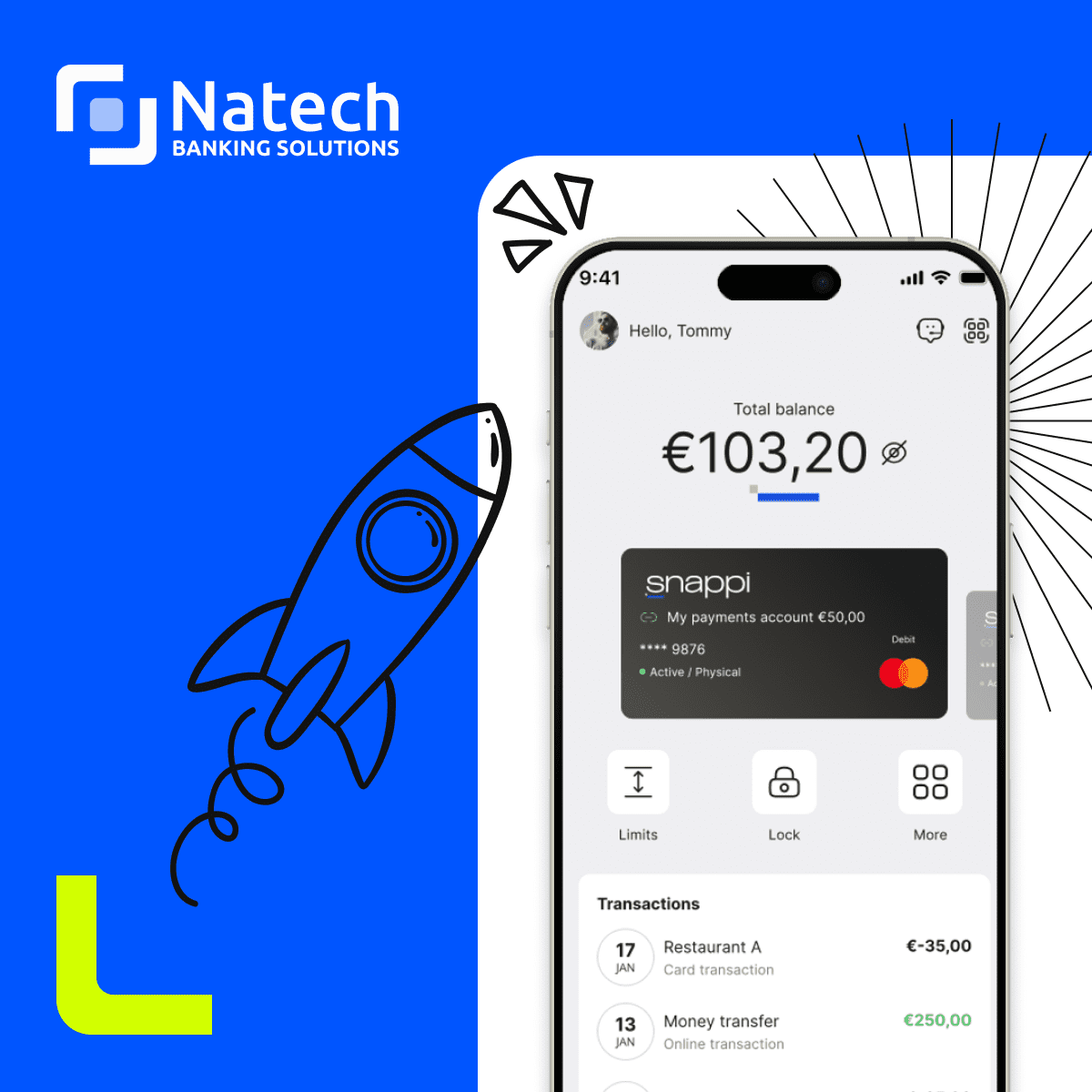

Natech's modular, cloud-native platform is powering new digital bank Snappi, demonstrating the scalability and agility of Natech’s technology in real-world neobanking.

Ioannina, Greece – September 23, 2025 – Natech Banking Solutions is proud to announce that Snappi, the first ECB-licensed neobank headquartered in Greece, and which runs on Natech’s modular banking platform, launched publicly on September 8 and has successfully onboarded over 10,000 new customers. This milestone affirms the appetite for digitally native financial experiences and the robust scalability of the underlying Natech platform.

Snappi is the first challenger bank of its kind in Greece: a fully digital, mobile-first bank offering modern banking services with zero fees, transparent practices, and 24/7 human customer support. With its European Central Bank license, Snappi represents a new generation of financial institutions built for speed, trust, and flexibility. The bank plans to expand progressively across the EU, offering inclusive, user-first services to underbanked segments.

Natech’s composable, cloud-native banking stack supports Snappi’s operations from onboarding and customer engagement to deposits, cards, payments, and the upcoming launch of a BNPL (Buy Now, Pay Later) feature called “Snappi Pay Later,” a flexible e-shopping experience that allows four interest-free payments. This partnership is founded on a shared commitment to designing banking solutions around life and creating financial products that resonate with younger demographics and digital-first users.

The Snappi partnership exemplifies Natech’s growing role in enabling next-generation financial services. As the leading banking technology platform in Southern Europe, Natech boasts a 100% customer retention rate, 40+ institutional customers, and a proven end-to-end banking platform. Natech is uniquely positioned to deliver secure, agile, and scalable solutions for both traditional institutions and new entrants. Its solutions include core banking, digital channels, AML, embedded finance infrastructure, and BaaS—all deployable in under 90 days.

Thanasis Navrozoglou, CEO of Natech and Vice Chairman of Snappi’s Board, commented, “Snappi represents the type of forward-thinking institution our platform was built to empower. This collaboration showcases how composable, cloud-native technology can deliver both agility and resilience, enabling banks to innovate with precision, respond to market shifts quickly, and scale responsibly. What’s more, the impressive customer take-up underscores the huge market opportunity to cater to underserved demographics, and we expect the Snappi offering to resonate across Europe.”

About Natech Banking Solutions

Natech Banking Solutions is the leading banking technology platform in Southern Europe, empowering financial institutions of all sizes to compete and grow alongside established competitors. With a modular, API-driven ecosystem, Natech enables institutions to rapidly launch financial products, modernize operations, and scale efficiently. The company maintains a 100% customer retention rate and is behind Snappi Bank, a digital-only bank driving innovation in Banking-as-a-Service. Headquartered in the emerging technology hub of Ioannina, Greece, Natech serves financial institutions across Europe with future-proof, cost-effective banking technology.